(You want the money in a savings account to make it easier and cheaper to access quickly.) This is a particularly difficult task to accomplish: In a 2018 Wells Fargo/Gallup Investor and Retirement Optimism Index survey, less than 40% of investors said they had enough savings to replace three or more months of income in an emergency.

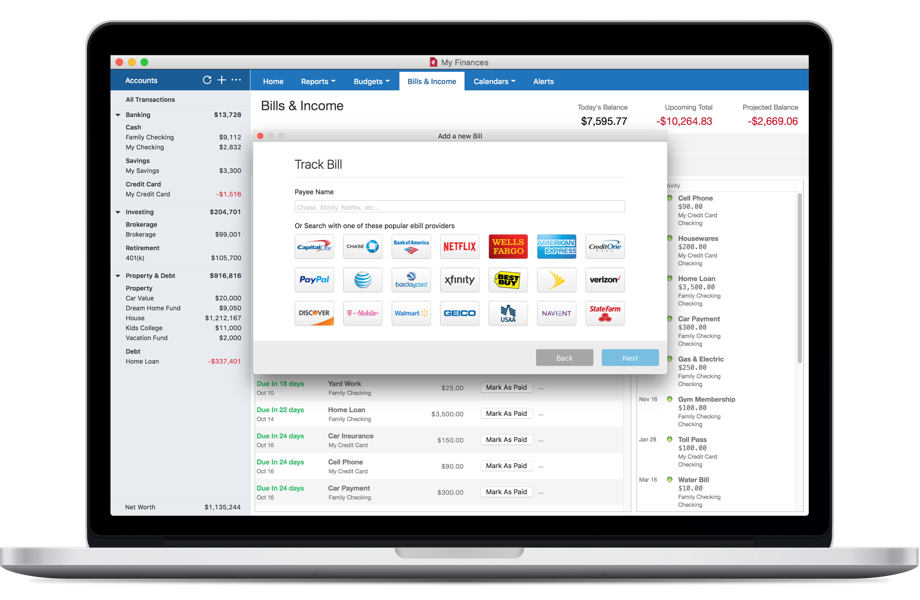

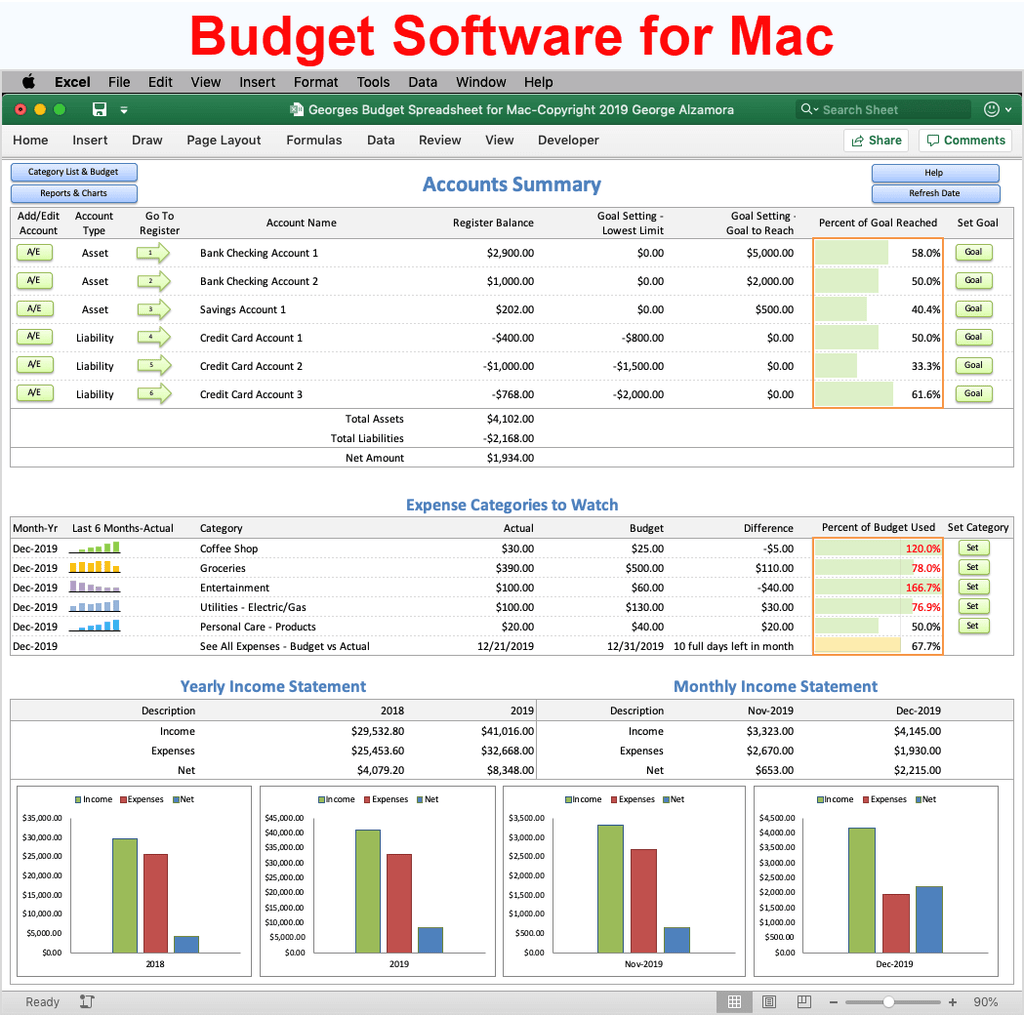

Spending less than you earn can also help you ratchet up your emergency fund-a pool of money, equal to three to six months’ worth of essential expenses, that sits in a savings account in case some unforeseen cost arises. After all, money is fungible: What difference does it make if you spend, say, $500 on groceries and $500 on dining out, as long as you arrive at the end of the month having shelled out less than you earned? Still, some may find categorizing expenses a helpful guardrail to stay on track and increase their savings. It is a little strange, though, when you take a step back. You divide your spending into different buckets and draw down on those buckets for the month until you get to zero. This is the hallmark of both Mvelopes and YNAB. Keeping tabs on what you actually spend will help you not only stay within the current month’s budget but also adjust your assumptions for next month’s. This was the service Mint so uniquely supplied when it launched back in 2006. As Olen points out, this can be tricky for some, but less so if you earn an income via a regular W-2. You need to have a guess as to how much you’ll earn to know how much you can spend. The accounts and categories used Quicken creates the budget based on personal expense transactions in all of your accounts except Invoice and *Sales Tax* accounts (Quicken Home & Business only). The rounding used Quicken rounds each budget amount to the nearest dollar.The budgeting method used Quicken creates the budget based on your actual monthly expenses for prior months, and your average monthly expenses for current and future months.If you don't have 12 months of transactions yet, Quicken creates the budget based on as few as 3 months of transactions.

#Quicken for mac budget full

The date range used Quicken creates the budget based on transactions from the previous 12 full months.If you want, you can add transfers and income categories later by clicking Select Categories to Budget at the bottom of the Budget window. It does not include transfers or income categories in the budget. The type of budget created Quicken creates a budget for all of your recurring personal expense categories.

It is often easier to let Quicken select the categories because you can always change the categories once the budget is created.

0 kommentar(er)

0 kommentar(er)